Overview

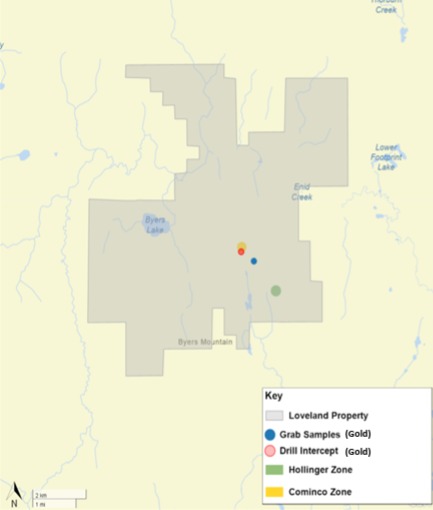

The Loveland Property is a high-potential gold, copper and nickel exploration project located about 35 kilometres northwest of Timmins, Ontario and 25 kilometres due west of the Kidd Creek Mine, within the world-renowned Abitibi Greenstone Belt.

The property covers 6,244 hectares (62 square kilometres, 24 square miles) across 292 mining claims and is surrounded by past-producing and active mining operations, making it a compelling asset in the well-established mineral district of Timmins.

The property’s close proximity to Timmins allows Loyalist to benefit from the many exploration service providers the city offers, and there is no need for a camp on site. The property is an hour drive from Timmins via Highway 101, providing reliable seasonal access, with additional access via trails.

Overview

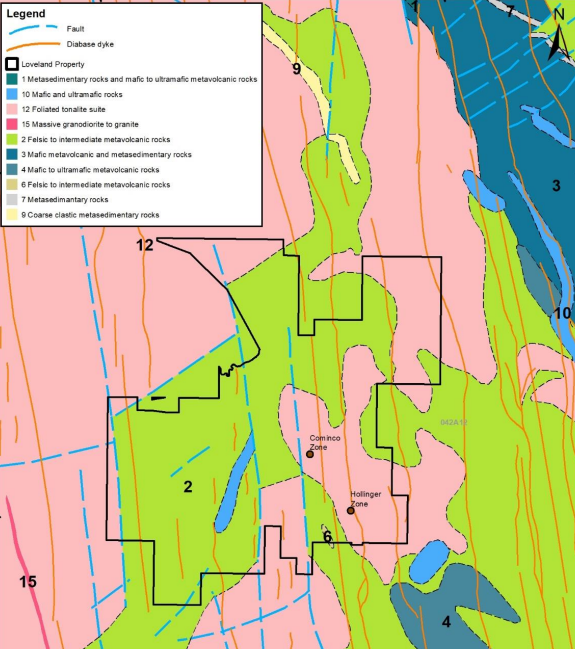

The Loveland property is underlain by volcanic rocks of the Kidd-Munro Assemblage, intruded by gabbroic and ultramafic bodies with limited surface exposure. Geology is interpreted from outcrop, drilling and geophysical surveys, highlighting a favourable setting for both magmatic nickel-copper and lode gold systems.

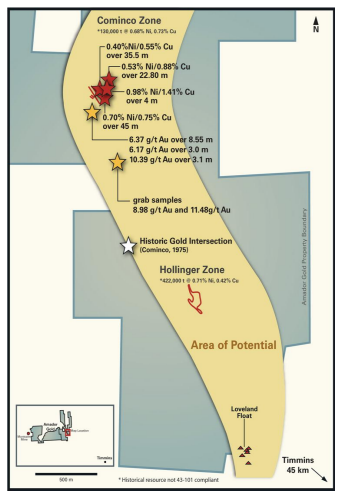

Nickel and copper mineralization occurs as semi-massive to massive sulfides—primarily pyrrhotite, chalcopyrite, and pentlandite—within gabbroic intrusions and along volcanic contacts. Two historical zones, the Hollinger Zone (422,350 tonnes at 0.71% Ni and 0.42% Cu) and Cominco Zone (130,000 tonnes at 0.73% Ni and 0.68% Cu), remain open for expansion.

Gold mineralization was also intersected beneath the Cominco Zone in altered granodiorite, with notable intercepts including 10.39 grams per tonne gold over 3.1 metres and surface samples returning up to 11.48 grams per tonne gold. These results support Loveland’s potential as a dual-target property for both critical and precious metals.

Overview

Both the Hollinger and Cominco zones have seen multiple campaigns of drilling since the 1970s, with strong nickel-copper sulfide intercepts including:

In addition to base metals, several gold-rich intervals have been recorded:

Surface grab samples returned assays of 8.98 grams per tonne gold and 11.48 grams per tonne gold.

We estimate that approximately C$10,000,000 has been spent on drilling historically. This encouraging mineralization underscores the polymetallic nature of the system and supports the potential for both bulk-tonnage and high-grade targets.

Overview

Loyalist Exploration acquired a 100% interest in the Loveland Property from STLLR Gold in 2025 through a transaction consisting of C$250,000 cash, 10 million Loyalist shares, and a 2% NSR, with a 1% buyback option for C$1,000,000.

The Company plans to advance Loveland through holistic interpretation of historical data, modern geophysical surveys and geochemical targeting techniques, and drilling to further define the mineralized zones and test for extensions and new discoveries.

With increasing global demand for nickel and copper in battery and electrification markets, as well as a rising gold value environment, Loveland represents a cornerstone asset in Loyalist’s exploration portfolio.